Are you navigating the complexities of auto loan payments, seeking a streamlined approach to managing your finances? Understanding the nuances of Capital One Auto Finance, from payment deadlines to late fee policies, is crucial for maintaining financial health and avoiding unnecessary charges.

The financial landscape has shifted significantly. Gone are the days when a bill payment was considered timely even weeks after the due date. Today, precision is paramount. Capital One, like many other credit card companies, has a specific late fee policy. These fees are triggered the moment a payment is made after 8 p.m. Eastern Standard Time on the day it's due. This underscores the importance of timely payments and understanding the specifics of your loan agreement.

For those looking to manage their Capital One auto loan effectively, a deep dive into the available resources is essential. Heres a breakdown of the key areas to focus on:

| Aspect | Details |

|---|---|

| Payment Methods | Capital One offers various payment methods to cater to different preferences. You can pay your auto loan bill online, by phone, or by mail. Each method has its specifics, and understanding them can help you choose the most convenient option. |

| Online Payments | To pay online, you'll typically sign in to your Capital One account. The platform will guide you through the process of selecting "Pay Bills" or "Bill Pay," depending on the interface. Make sure to add the payee first if you haven't already. Before you can utilize online bill pay, you must read and agree to the terms and conditions. |

| Automatic Payments (Autopay) | Capital One credit cardholders can easily manage their automatic payments through their online account or the Capital One mobile app. Once you're enrolled, Capital One will withdraw the payment amount from your linked bank account on the scheduled date. |

| Phone Payments | Another option is to pay by phone, which can be done by calling customer service at the number on the back of your card or the specific auto loan customer service number. You'll be guided through the payment process by a customer service representative. |

| Mail Payments | For those who prefer mailing payments, you'll need to know the correct mailing address. This information can typically be found on your billing statement or within your online account. Be sure to mail your payment well in advance of the due date to avoid any delays. |

| Payment Information | You'll need to have some essential details handy to make a payment, such as your account number, the routing number of your bank, and the payment coupon number. This ensures that your payment is correctly processed and applied to your account. |

Managing your auto loan effectively with Capital One Auto Finance involves more than just making payments. It requires a comprehensive understanding of various aspects to avoid potential pitfalls. Heres a detailed look:

| Key Aspect | Details |

|---|---|

| Payment Due Date | Knowing your due date is the first and most crucial step. Capital One clearly states your payment due date. Making payments on time, or even a few days early, helps avoid late fees and keeps your account in good standing. |

| Late Fee Policy | Capital One's late fee policy is straightforward. Fees are applied if your payment is made after a specific cut-off time. Being aware of this policy and adhering to it is vital to avoid penalties. |

| Avoiding Late Fees | Proactive strategies are key to avoid late fees. Setting up automatic payments through Capital One's online account or mobile app ensures that your payment is made on time every month. Alternatively, you can opt for manual payments, but make sure you mark your calendar or set reminders to avoid missing the due date. |

| Understanding Your Credit Report | Regularly reviewing your credit report is a good practice for any borrower. This lets you catch any errors or inaccuracies that could affect your credit score. Capital One provides resources to help you understand your credit report and how to interpret the information it contains. |

| Contacting Capital One | If you have questions about your auto loan, or if you encounter any issues, Capital One has multiple support options. You can reach out to customer service by phone, which is often the quickest way to get answers to your questions. Alternatively, you can manage your account online or through the mobile app, which gives you access to a range of tools and information. |

| Dispute Resolution | In the event of a billing dispute, Capital One provides a clear process for filing a dispute. You can send your dispute and supporting materials directly to Capital One Auto Finance at the address provided. This process ensures that your concerns are addressed and that any errors are corrected. |

Capital Ones online platform and mobile app also offer convenient features:

| Feature | Description |

|---|---|

| Account Management | Easily view account balances, pay bills, and transfer money, giving you a comprehensive overview of your financial activity. |

| Payment Activity Tracking | View your payment history to ensure all payments have been correctly applied to your account. |

| Due Date Management | Find out how to change your due date and avoid interest charges. |

| Autopay Enrollment | Easily enroll in autopay for your Capital One credit card online, via the mobile app, or by phone, helping you avoid late fees and manage payments efficiently. |

| Payment Amount Customization | Choose your payment amount, link your bank account, and control your payment schedule to suit your budget and financial needs. |

Capital One offers a comprehensive range of tools to manage your auto loan, including online access, mobile app support, and a dedicated customer service line. These resources make it easy for you to stay on top of your payments and keep your financial journey on track.

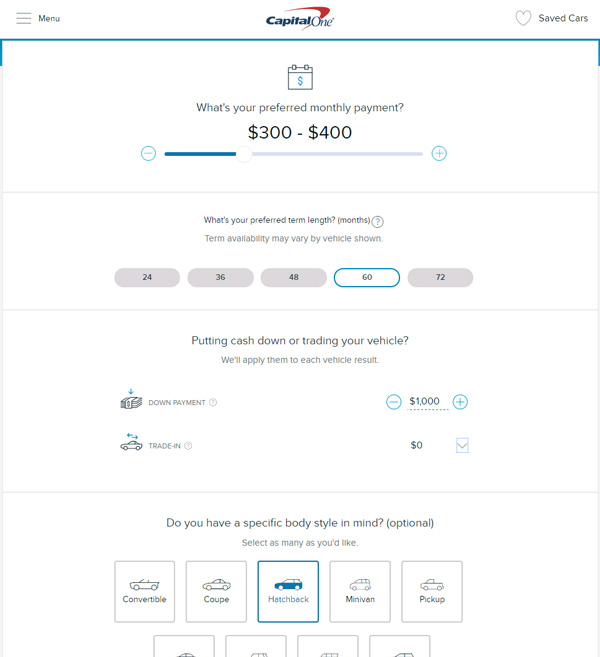

Beyond standard payment options, Capital One provides specialized services such as auto loan refinancing. This can be a strategic move for borrowers looking to optimize their loan terms and potentially lower their interest rates or monthly payments.

For borrowers considering refinancing, Capital One offers an easy online process. This allows you to apply and manage the refinance without the need for physical paperwork or in-person visits.

However, Capital One Auto Finance only refinances loans from other financial institutions. It does not refinance loans from Capital One subsidiaries. Also, your current lender needs to meet certain requirements. Reviewing these requirements is essential to determine if you qualify for refinancing with Capital One.

Capital Ones Auto Navigator service, accessible through their website or mobile app, provides an innovative and user-friendly interface. This service allows you to explore options for financing, refinancing, and managing your auto loan. With clear explanations and user-friendly navigation, the Auto Navigator helps you make informed decisions about your auto loan.

If you're ever worried about an upcoming automatic payment, you could contact your bank or credit card issuer and initiate a stop payment order while you're working on canceling future automatic payments. Ensure that you follow the correct procedures for canceling automatic payments to avoid any unintended charges.

In a world where financial transactions are increasingly automated, understanding and managing your auto loan payments with Capital One is critical to achieving financial stability. By taking a proactive and informed approach, borrowers can not only avoid late fees and protect their credit scores but also make informed decisions that contribute to a positive financial journey.

To streamline your experience, Capital One offers several support options and provides tips to help resolve issues promptly. If you already know which department you need to reach, you can find the phone numbers for credit card support, business accounts, loans, and more.

In summary, Capital One provides a comprehensive set of tools and resources designed to simplify auto loan management, empowering borrowers to take control of their finances. From online account access to mobile app convenience and specialized services, Capital One is committed to helping you manage your auto loan efficiently and effectively.