Are you adequately protected against unforeseen events on the road? Understanding the nuances of auto insurance, particularly comprehensive coverage, is crucial for safeguarding your vehicle and your finances.

Navigating the world of car insurance can often feel like traversing a complex maze. With myriad policy options, deductibles, and coverages, it's easy to feel lost in a sea of jargon. One of the most important aspects of auto insurance is comprehensive coverage, which plays a pivotal role in protecting your vehicle against a variety of perils beyond collisions.

Comprehensive coverage, in essence, is a form of protection that goes beyond accidents caused by another vehicle. It's the safety net that kicks in when your car is damaged by things like theft, fire, vandalism, or even natural disasters such as a hailstorm. But how does this coverage actually work, and what should you know before selecting a policy?

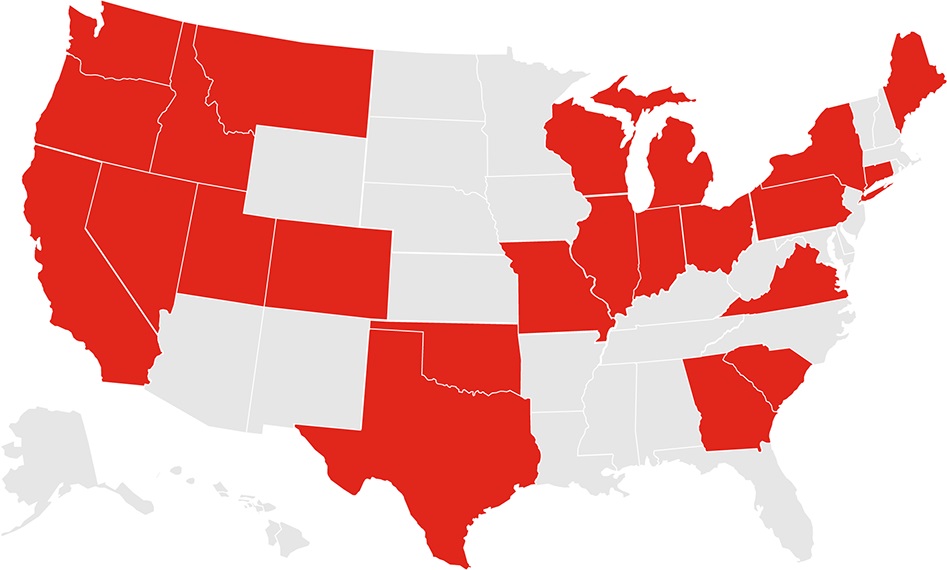

State Farm, a well-known name in the insurance industry, offers comprehensive coverage, but it's crucial to understand the specifics of their policies, as they can vary by state and individual agreements. This is particularly important regarding elements like paint damage, windshield repairs, and the overall cost-effectiveness of their offerings. Understanding the details is critical to making informed decisions.

In Kentucky, the experience of one customer, Novita Trumanto, highlights a potential point of contention. While many insurance companies in Kentucky do not require a deductible for cracked windshield repairs under comprehensive coverage, State Farm seemingly does. This discrepancy underscores the importance of carefully reviewing policy specifics and comparing options before committing to a plan.

For those considering comprehensive coverage, it's important to be aware of what's covered. State Farm's comprehensive policies may cover paint damage, but this, like other aspects of coverage, is subject to the terms and conditions of the specific policy. Generally, comprehensive coverage steps in to repair or replace your vehicle if it's damaged by something other than a collision, covering a range of events from theft to damage caused by falling objects.

When it comes to financial implications, the deductible you choose significantly affects the out-of-pocket expenses. The comprehensive coverage deductible that applies, is the lesser of the chosen amount. Choosing the right deductible is a critical factor in balancing your premium costs with the potential financial burden of a claim.

For those who prioritize budget, State Farm sometimes has the cheapest minimum coverage rates for drivers who don't require extensive coverage options such as comprehensive and collision. This can be attractive to drivers who are simply looking for the most basic protection. But the cost is usually only a secondary consideration. Insurance policies are contracts, and understanding their intricacies, especially regarding comprehensive coverage, is key to ensure your vehicle is well-protected. Always contact a State Farm agent to gain a precise grasp of different coverage options available to you for your vehicle.

Beyond the basics, its worthwhile to consider how State Farm handles scenarios such as stolen vehicles. Comprehensive coverage, including any car rental and discount offers, is a vital financial safety net in such situations. It helps policyholders with the expense of replacing their vehicle and offers support during the recovery process.

When storing a vehicle for an extended period, usually 30 days or more, you may be able to suspend liability and collision coverage. You can retain only comprehensive coverage to reduce your premiums while keeping your vehicle protected from non-collision risks. Its always wise to contact your agent to receive the exact details for your situation.

It's important to remember that insurance policies, and coverage details, often change depending on your state and endorsements. To get the best, most accurate coverage, its essential to consult directly with a State Farm agent.

Understanding what your policy covers is essential. State Farm provides explanations of coverage options. However, keep in mind that these explanations are general summaries, and the details of your specific coverage may vary based on your state and individual agreement. The best way to gain clarity is to carefully review your policy documents and consult with your agent.

When it comes to windshields, some State Farm policies include whats known as full glass coverage. This means repairs or replacements of your windshield may be done without a deductible. In contrast, other policies may require policyholders to share the cost, depending on the terms of their agreement.

The process of handling claims might involve State Farm settling with you or the owner of the vehicle in the event of a claim. They have the choice to pay for repairs to the covered vehicle, minus any applicable deductible. All coverages are subject to policy provisions and applicable endorsements.

Key Considerations for State Farm Comprehensive Coverage:

- What's Covered: Theft, vandalism, fire, natural disasters, and other non-collision damages.

- Deductibles: Choose an amount that fits your budget, and risk tolerance.

- Windshield Coverage: Varies. Some policies have no deductible; others share costs.

- State Variations: Coverage terms and availability can vary by state.

When thinking about your insurance needs, always be sure to carefully read the policy booklet and reach out to your State Farm agent. They can provide a personal touch and answer any specific questions you might have.

| Aspect | Details |

|---|---|

| Company Name | State Farm |

| Founded | 1922 |

| Industry | Insurance |

| Headquarters | Bloomington, Illinois |

| Key Products | Auto insurance, Homeowners insurance, Life insurance, Health insurance |

| Employees | Approximately 58,000 |

| Ranking (Fortune 500, 2024) | #39 |

| Notable Facts |

|

| Parent Company | State Farm Mutual Automobile Insurance Company |

| Website | www.statefarm.com |